This refers to cash received from customers for previous sales made on credit. For example, received $500 cash from a customer who purchased goods on credit. While it might seem like debits and credits are reversed in banking, they are used the same way—at least from the bank’s perspective.

Related AccountingTools Courses

Finally, the double-entry accounting method requires each journal entry to have at least one debit and one credit entry. Inventory is an essential aspect of any business, but it’s not without its advantages and disadvantages. One of the main benefits of inventory is that it can help businesses meet customer demand quickly by having products readily available.

- Inventory is a term used to describe the goods and materials that a business holds in stock for sale or production.

- Understanding the difference between these two concepts is crucial for managing your business’s finances effectively.

- Ultimately, the right accounting software can help you stay more organized, reduce errors, and give you a better picture of your company’s financial health.

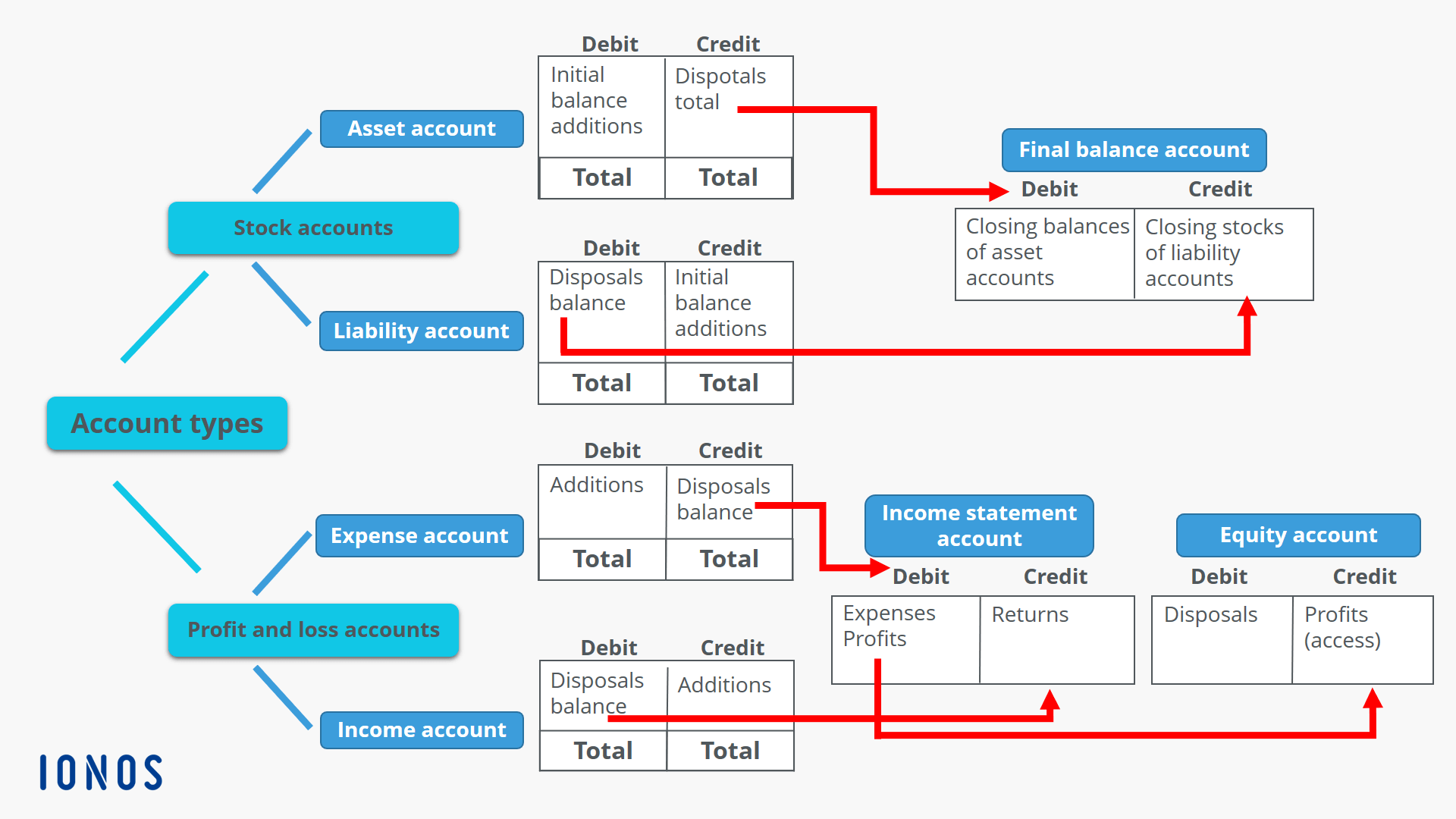

How Are Debits and Credits Recorded?

Many companies will opt to use the FIFO inventory method to offload their older stock first, and is most often used by business with perishable inventories. Inventory is classified as a current asset and will show up as such on the business’s balance sheet. If you’re still unsure about which method is best for you, consider consulting with an experienced accountant who can provide tailored advice based on the unique needs of your business. With the right approach to inventory management, you can set yourself up for long-term success in procurement and beyond. Firstly, consider what type of inventory system you have – periodic or perpetual.

3.2 Merchandising Transactions (perpetual inventory system) with Discounts – The Seller

This represents the wages or salaries owed to employees that have been earned but not yet paid. For example, a business accrued $1,000 in wages for the current pay period. Debit your Cost of Goods Sold account and credit your Finished Goods Inventory account to show the transfer. Debit your Finished Goods Inventory account, and credit your Work-in-process Inventory account.

Companies and individuals must produce the appropriate financial statements and income tax returns each year as dictated by their country’s revenue collection agency. Failure to comply with this will result in fines, penalties and possible incarceration. If Mary were to buy 50 wine glasses at $12 each, and then order another 50 wine glasses but this time, paying $16 each, she would assign the cost of the first wine glass as resold at $12. Once 50 wine glasses have been sold, the next 50 glasses will be set at the $16 value, no matter what additional inventory was purchased within that time. This technique provides businesses with an accurate depiction of the ending inventory and its value.

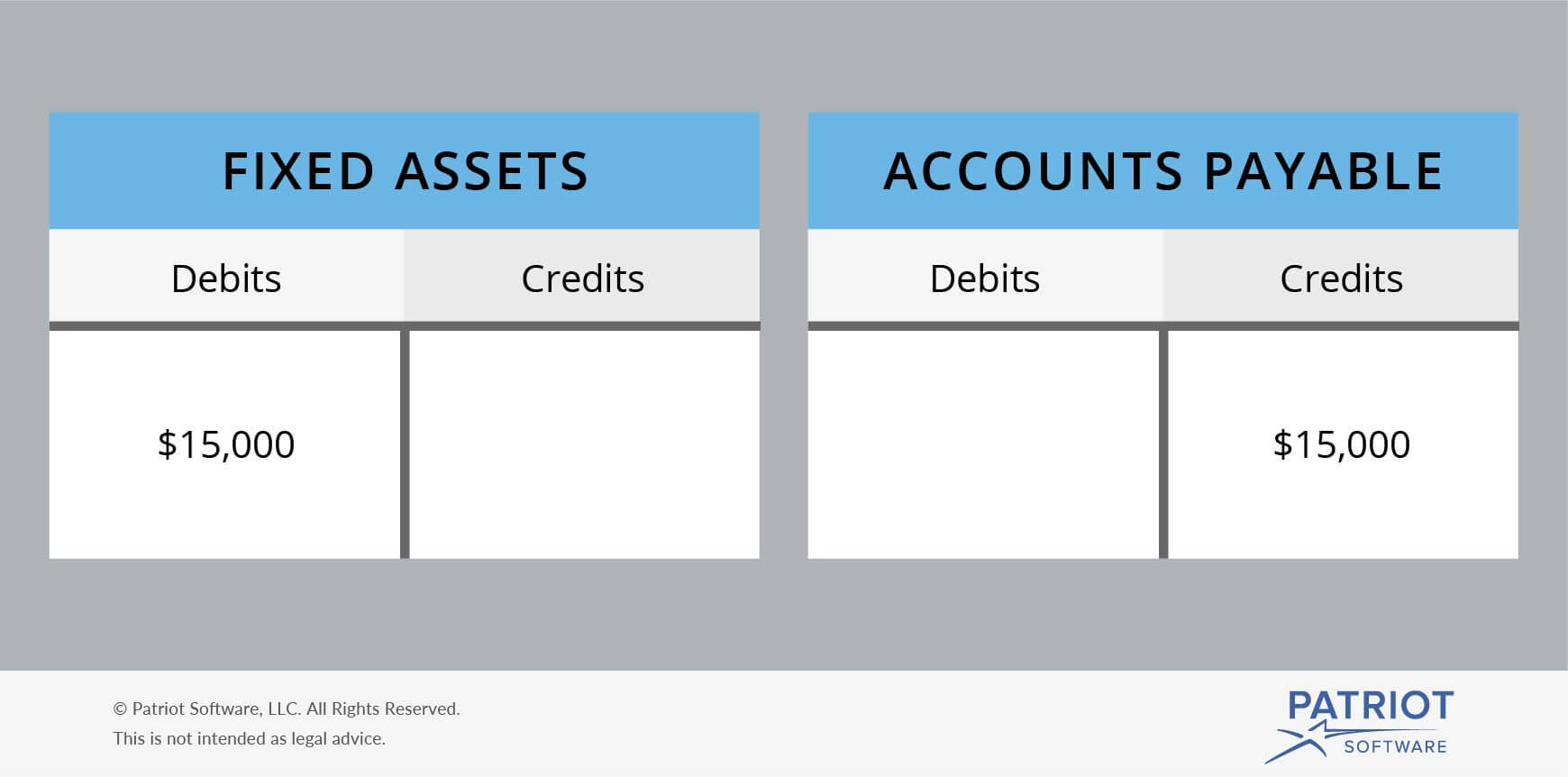

Unless this is accurately captured in the company financials, the value of the company’s assets and thus the company itself might be inflated. Let’s take a look at a few scenarios of how you would journal entries for inventory transactions. Credits increase your equity because they show value being added to your business.

This article will break down what debits and credits are and how using these tools help to balance your company’s balance sheet. Holding onto excessive amounts of stock ties up capital that could be used elsewhere in the business such as funding production costs or investing in new product development initiatives. Additionally, storing excess stock incurs additional warehousing expenses such as rent and insurance which can negatively impact profits. To balance books properly and avoid errors, each transaction must have equal amounts between debits and credits through double-entry bookkeeping technique.

A company’s liabilities are obligations or debts to others, such as loans or accounts payable. Inventory overage occurs when there are more items on hand than your records indicate, and you have charged too much to the operating account through cost of goods sold. Inventory shortage occurs when there are fewer items on hand than your records indicate, inventory debit or credit and/or you have not charged enough to the operating account through cost of goods sold. Record the cost of goods sold by reducing (C) the Inventory object code for products sold and charging (D) the Cost of Goods Sold object code in the operating account. Goods for resale are purchased through the purchase order process (follow purchasing procedures).